The processing facility of the Pumpkin Hollow underground mine has commenced production using development ore from mine construction, and the underground mine itself is expected to commence production before end of 2019. The mine benefits from a number of important, low risk advantages, including a highly-skilled team of mine operators, a supportive local community, established infrastructure, and a desert climate and local topography optimal for efficient and eco-friendly mining techniques such as dry-stack tailings.

Pumpkin Hollow Underground Mine

Underground Mine Highlights

- Robust economics

- Competitive OPEX

- Strong production profile

- Significant cash generation

- Long life

- Expansion potential

| Project Economics1 | Post-Tax 25% IRR and US$301M NPV5% (post construction) |

| Opex2 | First 5 Years LOM |

| Production Profile | Y1-5 annual avg. of 60 Mlbs Cu, 9 koz Au, 173 koz Ag LOM annual avg. of 50 Mlbs Cu, 8 koz Au, 150 koz Ag |

| Annual Operating cash flow | Average US$80m per annum over first five years3 |

| Reserves | 23.9 Mst @ 1.74% Cu eq. (1.98% Cu eq. over first five years)4 |

| Mine Life | 13.5 years |

| Expansion | Extension potential from 636 Mlbs CU5 of inferred resources Production growth potential via optimization initiatives |

1. NI 43-101 Technical Report: Nevada Copper Corp., Pumpkin Hollow Project, Open Pit and Underground Mine Prefeasibility Study (PFS) with an effective date January 21, 2019.

2. AISC is defined as C1 plus sustaining capital expenditures.

3. Consensus prices per the 2019 NI 43-101 Tech Report : US$2.83 – 3.20/lb Cu, US$1,276 – 1,325oz Au, US$18.77-$20.01/oz Ag.

4. Cu-equiv based on prices of $3.00/lb Cu, $1,300/oz Au and $17.00/oz Ag and met recoveries of 92%,78% and 70% respectively.

5. Inferred resources, 29 Mst grading 0.1.09% Cu

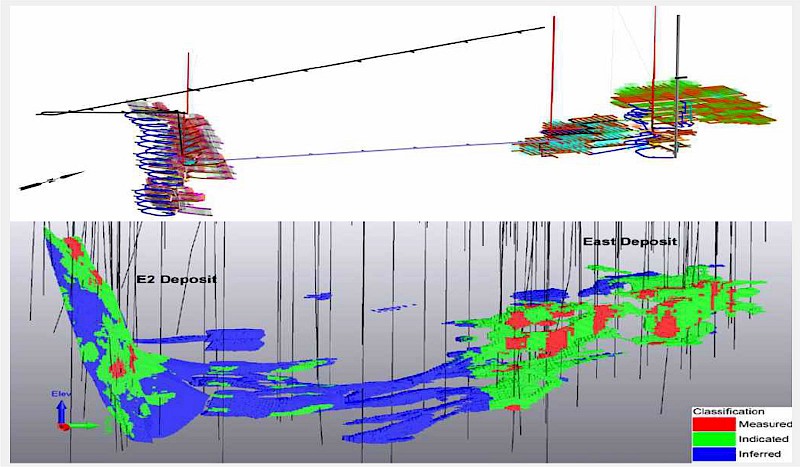

Extension Options

Significant Underground Resouce Upside

Large quantity of inferred resource mineralization (approx. 636M lbs copper) presents opportunity to upgrade with underground drilling