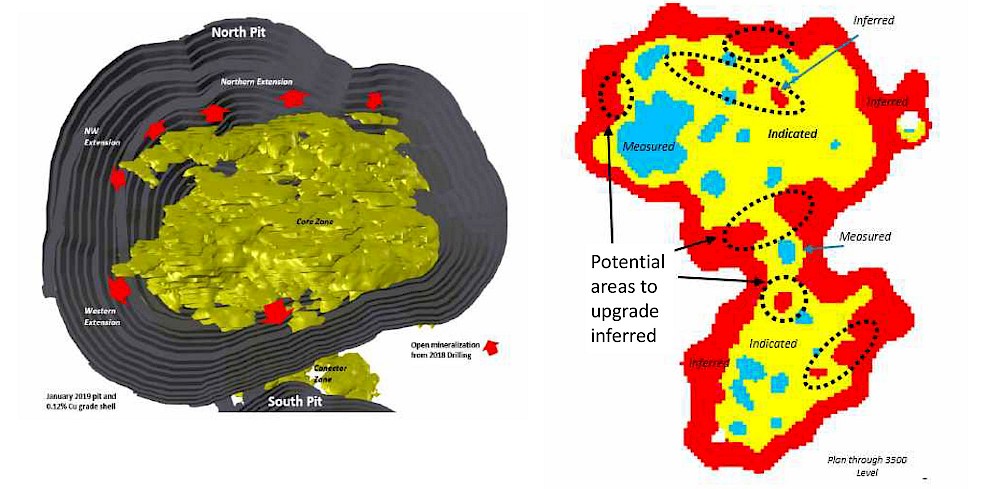

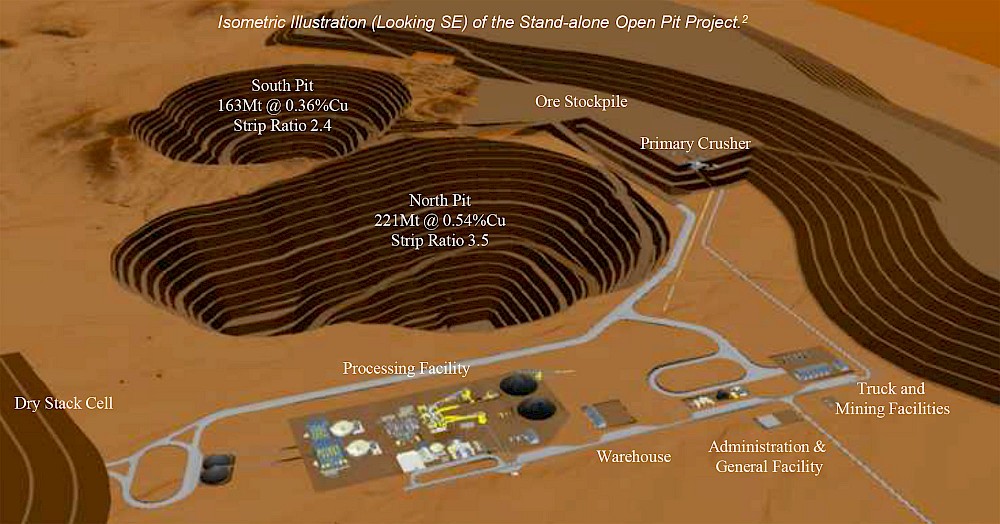

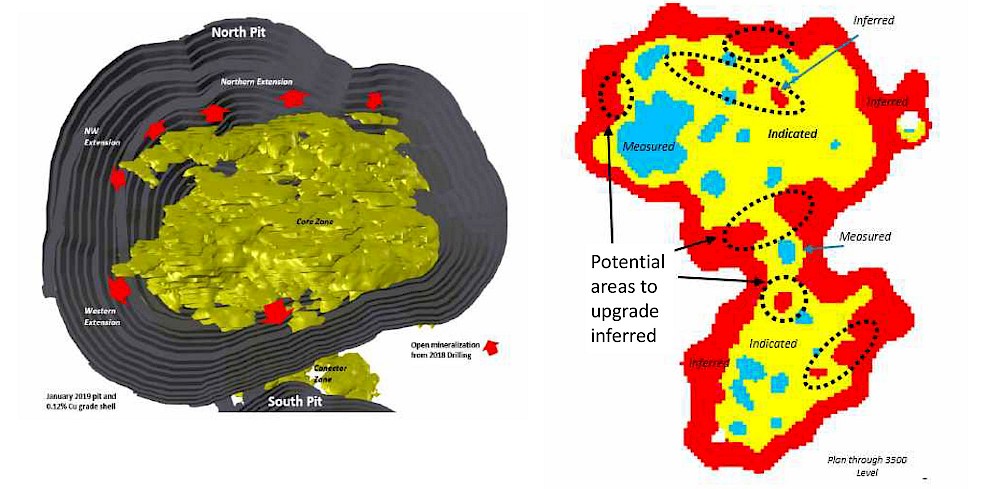

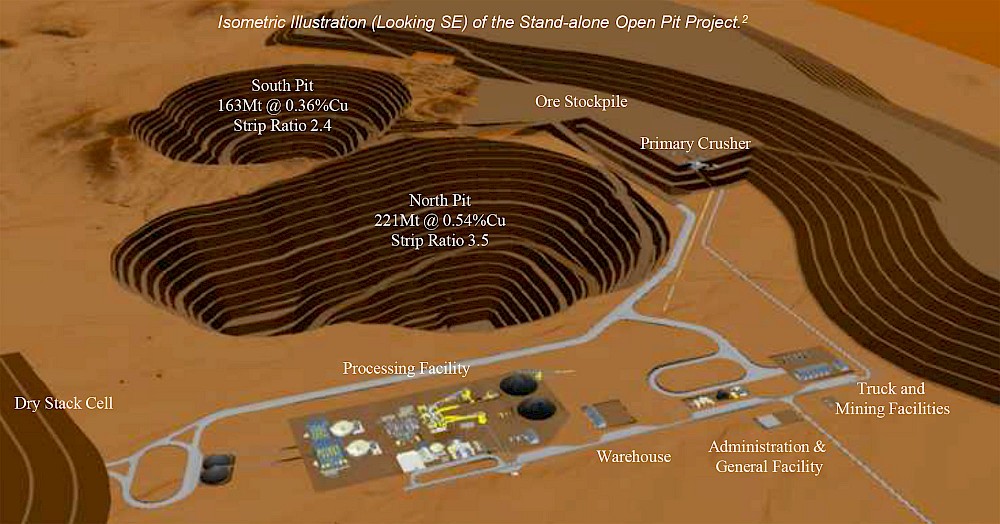

The Pumpkin Hollow open pit development is approximate 4 km west of the underground mine. It includes two large deposits and areas of potential expansion both in and outside of the projected pit walls. The recent pre-feasibilty study has highlighted the potential for improved economics, simplified build and phased expansion.

The open pit has several areas of possible expansion, such as a significant quantity of Inferred Resources (197M lbs Cu6) that were excluded from the current resource model. There is also the demonstrated potential to test the full extent of deposit at depth and in areas within and outside of the current pit shell. Nevada Copper is currently advancing the open pit to feasibility stage, with the goal of making a construction decision thereafter.

Open Pit PFS Highlights

- Robust economics

- Low upfront capex

- Competitive opex

- Long life

- Excellent recoveries

- Strong EBITDA

- Significant cash generation

- Expansion potential

- Potential financing partner

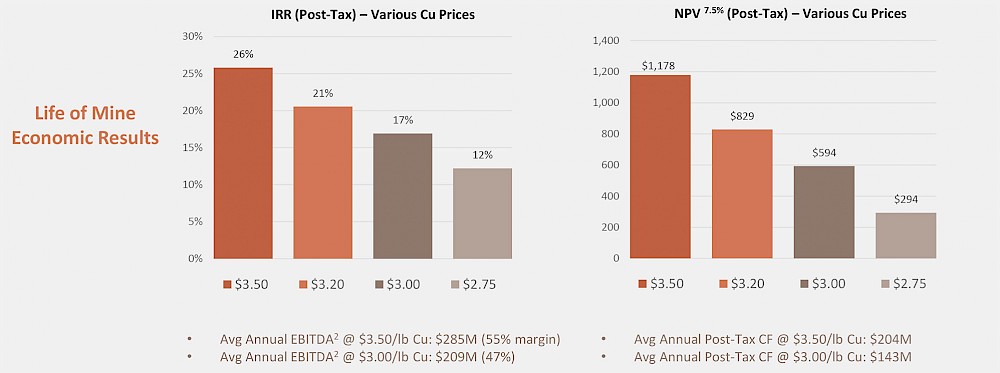

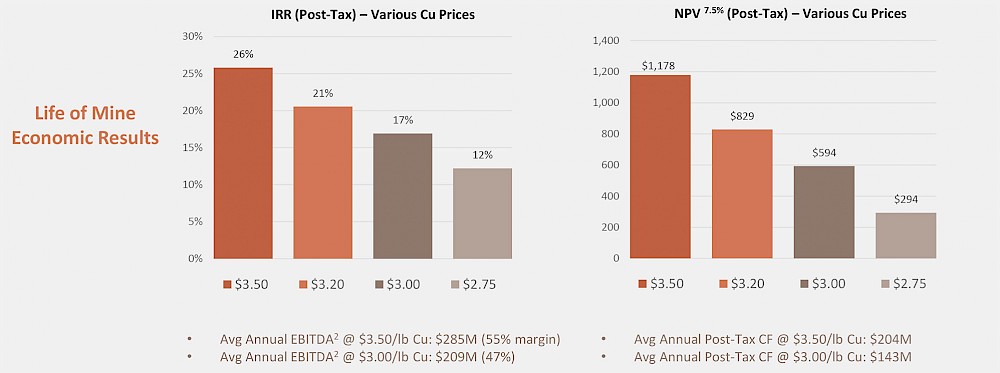

| Project Economics | Post-Tax 21% IRR and $829M NPV7.5% |

| Capex | Pre-production capex: US$672 million |

| Opex2 | $1.73/lb Cu (C1) and $2.03/lb Cu (AISC)5 |

| Mine life4 | 19 years production. 386 Mst @ 0.50%CuEq (0.69%CuEq first 5 yrs) |

| Cu Recoveries | North Pit 90% South Pit 88% |

| EBITDA5 | $239M per annum life of mine average |

| Annual free cash flow3 | Avg cashflow $180Mpa of 17 steady state years |

| Expansion potential | Inferred in pit & mineralization open to the North & West |

| Potential financing | Nevada Copper has already partnered with KfW IPEX Bank to complete the underground mine |

1. Technical Report, entitled “NI 43-101 Technical Report: Nevada Copper Corp. Pumpkin Hollow Project, Open Pit and Underground Mine Prefeasibility Study (PFS)”, with an effective date of January 21st, 2019.

2. AISC is defined as C1 plus sustaining capital expenditures.

3. Utilizes long-term copper price of $3.20/lb.

4. Cu-eq. calculated using prices with process recoveries based on pit location: Cu $3.20/lb with 90% to North ore and 88% to South ore; Au $1,325/Oz & 67.3% for both North and South ore; and Ag $20.01/Oz & 56.3% for both North and South.

5. EBITA and AISC are Non-IFRS measures. For more information please see “NI 43-101 Technical Report: Nevada Copper Corp. Pumpkin Hollow Project, Open Pit and Underground Mine Prefeasibility Study (PFS)”

6. Inferred, 28 Mst grading 0.358% Cu

Conventional Truck-and-Shovel

- Low capital intensity of US$9,544/annual tonne of Cu-eq production1

- Phased production growth comprising initial production scale of 37kstpd with potential expansion to 70kstpd

- Potential to fund ongoing development work and construction through future cash flows from Underground Project, reducing need to access equity capital markets

1. Based on 37kstpd mill feed period of copper production, after ramp-up

Robust Economics and Optionality1

- Strong economics for the open pit production plan

- LoM of 37kstpd for 6 years and then 13 years at 70kstpd production rate (19 years)

- Timing of expansion to 70kstpd is flexible and decision will be based on market conditions.

There is no obligation to expand in a specific year for technical reasons

Sensitivity analysis shows that without the 70kstpd expansion, favorable economics are delivered with a 29 year LOM and a post-tax NPV 7.5% of $643M and a 19% IRR

1. Technical Report, entitled “NI 43-101 Technical Report: Nevada Copper Corp. Pumpkin Hollow Project, Open Pit and Underground Mine Prefeasibility Study (PFS)”, with an effective date of January 21st, 2019.

2. EBITA is a Non-IFRS measure. For more information please see NI 43-101 Technical Report: Pumpkin Hollow Project, Open Pit and Underground Mine Prefeasibility Study (PFS)

Expansion Potential

Open Pit Exploration

Drill test open extensions to the Open Pit ore body and follow up on 2018 results

- Drill test the new, shallow mineralization in the Northern & NW Extension areas,

- Drill test a possible offset of mineralization west of the open pit

- Drill test the connector zone between the north and south pits

Open Pit Advancement

Infill drilling of in-pit inferred material to increase resource tonnage and grade

- Current resource model excludes Inferred Resource mineral inventory (197M lbs Cu)

- Drill areas classified as waste rock and Inferred with goal to convert to Indicated resources in pit and on boundary (open mineralization) and upgrade areas of poor core recovery

- Drill-test targets that fall within proposed infrastructure