Nevada Copper Announces Q1-2018 Drill Program and Open Pit Optimization and Development Plan

November 28, 2017: Nevada Copper Corp. (TSX: NCU) (“Nevada Copper” or the “Company”) is pleased to announce its resource extension drilling plan for Q1-2018 and provide an update on its 100% owned Pumpkin Hollow Project for 2018, including both the Underground Project and Open Pit Project development plans for 2018.

Highlights of 2018 Development Plan

- Restart of Underground Project construction: Following the previously announced Underground Project Pre-Feasibility Study for Pumpkin Hollow, Nevada Copper is moving swiftly towards the re-commencement of project construction with further project updates to follow over the coming months, including:

- Management and project team additions;

- Engagement of project consultants to complete basic and detailed engineering to facilitate a construction decision;

- Procurement of long lead items and engagement of mining contractor; and

- Project financing.

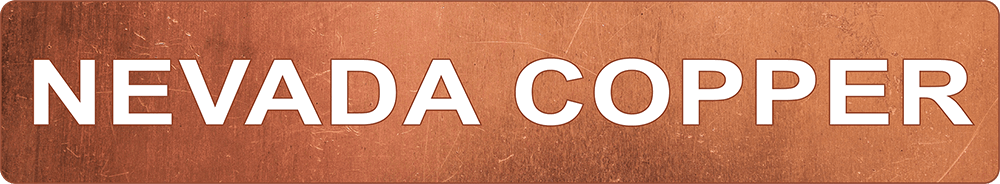

- Commencement of Open Pit Project resource extension drilling: A key value driver for Nevada Copper is the further delineation of previously undrilled extensions to the Open Pit Project resources (Figure 1. below):

- Drilling to commence early Q1 2018, with an initial low-cost 10,000 meter program that will be increased on a success basis focused on specific high-potential resource extension zones in the North deposit;

- Drilling completed subsequent to the 2015 Integrated Project Feasibility Study, contained mineralization in zones currently not included in the Open Pit project economics;

- Additional well defined, low-risk targets were not previously drilled due to the now-completed land swap and project permitting process; and

- Potential to convert material currently classified as waste into resources and minable inventory. A quarter of the currently defined higher-grade North pit remains untested.

- Open Pit Optimization: Significant scope identified to improve Open Pit Project economics, reducing pre-production capital and increasing the project’s Internal Rate of Return, in line with the Company’s focus on near-term production and a philosophy of “margin-over-tons”, including:

- Extensional drilling with the aim to convert “stripping waste” into payable ore;

- Re-costing of project inputs to reflect the current low point in the mining capex cycle;

- A smaller start-up option focused on the higher-grade North deposit; and

- Target to re-define Open Pit Project economics during 2018, with a view to near-term project development.

Restart of Underground Project Construction

As announced on November 20, 2017, the Company is proceeding to complete and SEDAR-file a Technical Report (“Technical Report”) that discloses a new 5,000 tons/day underground mine development option (“Underground Project”). The Company is moving towards a project financing package which will involve our largest shareholder, new investors and its senior lender. Completion of the project financing package will allow for a construction decision by Q2-2018 leading to first production in 2019. Nevada Copper will provide a further update as details are finalized.

In early 2018, the Company plans to execute an EPC contract for the process plant, and start assembling its construction execution, operation and mine build team.

Commencement of Open Pit Project Resource Extension Drilling

As a result of its higher grade and untested zones, the North deposit of the Open Pit Project, offers significant scope for value creation.

The Mineral Reserves[1] for the North deposit at 300 million tons has a grade of 0.445% (0.471% Cu-equiv.[2]), approximately 39% higher than the South deposit average. Further, the planned mill feed grades from the North deposit in the first four years of production are 0.56% Cu (0.60% Cu-equiv.). This is within a total open pit Mineral Reserve of 539 million tons grading 0.39% copper[3].

Until the acquisition of the Federal land had been completed in late 2015, Nevada Copper had deferred any drilling on the lands across the northern boundary of its patented claims, land beneath which we believe are extensions of the North deposit. With this land now wholly-owned, the Company is free to test for the northern extension of the North deposit without the need for Federal permits. Nevada Copper considers that the North deposit has excellent potential for resource expansion to the north and to the west. If successful, drilling along with technical studies also has the potential to convert material classified as waste into ore in areas that have not been drilled historically.

2018 Drill Program

In order to test the North deposit extensions and support a new 2018 mineral resource for the North deposit, an initial 10,000 meter (33,000 foot) drill program is planned with an initial budget of $2.5 million. This budget will be increased on a success basis and will be followed by an updated Mineral Resource which will lead to a future feasibility study to evaluate a smaller North Deposit open pit development, as described above. Drilling is expected to start in early Q1-2018 and will be subject to completion of a financing package discussed above.

North Deposit: Northern Extension (“Northern Extension”)

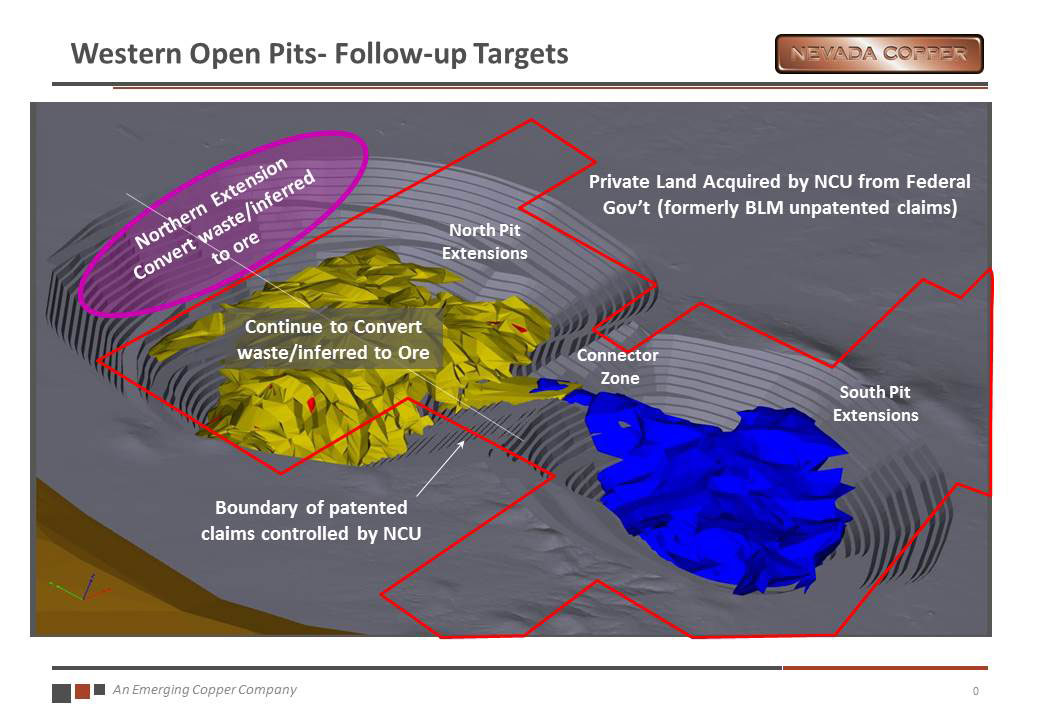

The figures below demonstrate the importance of drilling the Northern Extension for both resource and pit design. Approximately a quarter of the North pit does not have any drilling. Extending and intersecting mineralization within these areas will add to mineral resources while reducing waste tonnages.

Drill results in 2015 from the center of the North pit demonstrated that additional drilling could have a considerable influence on converting waste into mineral resources in the core of the deposit. Several holes in the center of the North deposit including NC15-16, all intersected multiple zones of mineralization. The upper zones correlated well or enhanced existing mineralization. The new lower zones help fill in areas where drill density is limited and the rock is currently classified as waste or inferred. This is an area that would benefit from additional drilling.

Below is a cross section (Figure 2) that includes drill-hole NC15-16, and shows how the mineralization intersected in that hole has been expanded (red dash). In NC15-16 intersected a much larger shallow high-grade zone than the adjacent holes, 126.0 feet true thickness grading 1.29% Cu. Expanding this area will have a positive effect on the copper grades in the early years of production from the North deposit.

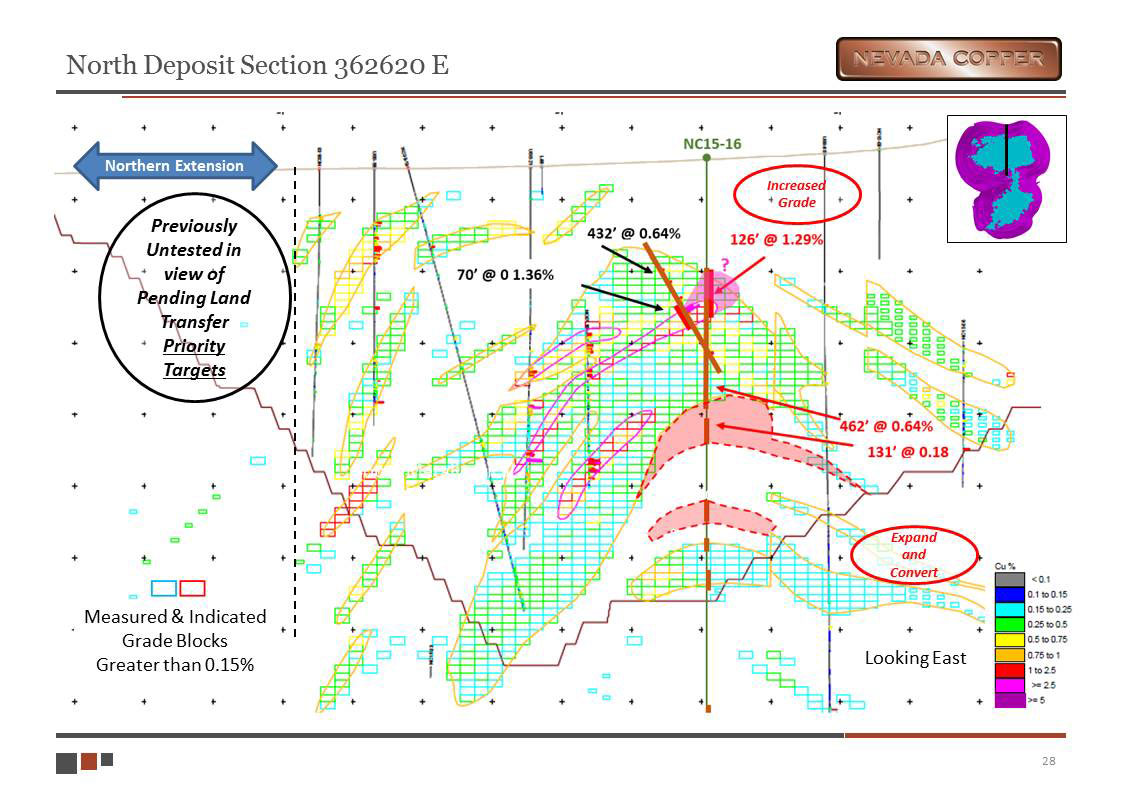

North Deposit: Connector Zone Drilling

The Connector Zone refers to the “saddle area” between the North and South deposits. Like the Northern Extension, parts of the Connector Zone were affected by the land acquisition process which restricted the ability to follow up very promising drill results such as NC12-03 below. With this land now wholly-owned, the Company is free to test all areas of the Connector Zone.

Connector Zone drilling in 2012 encountered substantial widths of high grade copper mineralization that was followed up with drilling in 2015. An example was drill-hole NC12-03 located along the North deposit’s south border which intersected high grade mineralization on the edge of the open pit limits, NC12-03 intersected 122.7 feet (37.4 meters) true thickness grading 3.96% copper, 0.384 grams/tonne gold, and 14.2 grams/tonne silver.

In 2015, NC15-13 drilled on the bridge of the pits intersected shallow mineralization 63.9 meters (209.5 feet @ 1.39% Cu), true thickness (Figure 3). Just northwest of NC15-13, drill hole NC15-03 intersected over 42.8 meters (158.0 feet @ 0.79% Cu), true thickness. Some of these holes lie outside the ultimate pit designs.

With the holes already drilled, together with any follow-up drilling success and additional engineering studies, the configuration of the pit design on the southern edges would likely change and add mineral resources while reducing waste tonnages.

As part of the optimization of a North deposit mine development plan, the information from Connector Zone drilling would be continued and incorporated into a new mineral resource along with new information from North Extension drilling.

Open Pit Development Optimization

In 2018, parallel to the advancement of the Underground Project, Nevada Copper will continue to evaluate opportunities to significantly improve the economics of the Open Pit Project.

Phillip Day, Chief Operating Officer of Nevada Copper, commented: “We believe there is significant scope to optimize the development scale of the Open Pit Project by right-sizing production rates and focusing on lower initial capital costs, with mill feed sourced from the higher-grade North deposit. This is a further application of our “Margin-over-Tons” operating philosophy. These opportunities are further enhanced by the potential to reduce assumed waste stripping volumes as a result of the drill program targeting the Northern and Connector Extensions zone to expand and follow-up the known areas of potential high-grade mineralization.”

Investigation of these optimization opportunities commenced in 2016 and, moving into 2018, Nevada Copper will focus on demonstrating specific opportunities and defining an optimized development plan in more detail including:

- Define smaller start-up option:

- Restricting initial operations to the higher-grade North deposit; and

- Resize project scale appropriately to lower capital costs with a possible production rate range of 30-40,000 tpd (versus the existing 70,000 tpd assumed in the 2015 Integrated Feasibility Study).

- Update capital and operating costs to reflect current cost environment:

- Initial reviews undertaken indicate opportunities to realize savings as a result of re-quoting key capital items in the current lower cost environment.

- Re-commence drilling on the North deposit and refine pit design:

- Test the northern and western extensions of the North deposit;

- Extend the area of known high-grade mineralization in the Connector zone on the southern limit of the current pit design; and

- Combining drill results with ongoing technical studies has the potential of converting material currently classified as waste into ore. The resultant increase in tons and reduction in waste stripping requirements could significantly improve project economics.

Giulio Bonifacio, President & CEO of the Company commented: “With the Underground Project set to proceed, we are working in parallel on the optimization of a western area open pit mine development following the same philosophy applied in the recently-completed high-grade Underground Project optimization. Drilling to extend North deposit resources and a re-scaled open pit development, represents a tremendous opportunity to add further value to Pumpkin Hollow and, equally exciting, such a larger development is allowed within our current permits.

Pumpkin Hollow is a truly unique, robust base metal asset that is fully-permitted in a top-tier location with built-in growth potential and upside both by way of the underground development plan and the large open pit deposits and proposed development plan which will be further advanced in 2018.”

Qualified Persons

The information and data in this news release was reviewed by Gregory French, P.G., Vice-President & Project Manager of Nevada Copper and Robert McKnight, P. Eng., Executive Vice-President of Nevada Copper, both of whom are Non-independent Qualified Persons within the meaning of NI 43-101.

NEVADA COPPER CORP.

Giulio T. Bonifacio, President & CEO

Figure 1. Open Pit Drill Target Area

Figure 2. North Deposit North South Cross-section

Figure 3. North Deposit North South Cross-section

Cautionary Language

This news release includes certain statements and information that contains forward-looking information within the meaning of applicable Canadian securities laws. All statements in this news release, other than statements of historical facts, including metal price assumptions, cash flow forecasts, projected capital and operating costs, metal or mineral recoveries, mine life and production rates, and other assumptions used in the pre-feasibility and feasibility studies, the likelihood of commercial mining, securing as strategic partner, expanding the mineral resources and reserves and possible future financings are forward-looking statements. Such forward-looking statements and forward-looking information specifically include, but are not limited to, statements concerning: the Company’s plans at Pumpkin Hollow Project; the estimated mineral resources and mineral reserves at Pumpkin Hollow; the estimated metal production of Pumpkin Hollow and the timing thereof; capital and operating costs of Pumpkin Hollow, future metal prices and cash flow estimates derived from the foregoing; and the closing of the Bridge Loan.

Forward-looking statements or information relate to future events and future performance and include statements regarding the expectations and beliefs of management and include, but are not limited to, statements with respect to the estimation of mineral resources and reserves, the realization of mineral resources and reserve estimates, the timing and amount of estimated future production, capital costs, costs of production, capital expenditures, success of mining operations, environmental risks and other mining related matters. Often, but not always, forward-looking statements and forward-looking information can be identified by the use of words such as “plans”, “expects”, “potential”, “is expected”, “anticipated”, “is targeted”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or the negatives thereof or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. Forward-looking statements or information include, but are not limited to, statements or information with respect to known or unknown risks, uncertainties and other factors which may cause the actual industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information.

Forward-looking statements or information are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements or information, including, without limitation, risks and uncertainties relating to: history of losses; requirements for additional capital; dilution; loss of its material properties; interest rates increase; global economy; no history of production; future metals price fluctuations, speculative nature of exploration activities; periodic interruptions to exploration, development and mining activities; environmental hazards and liability; industrial accidents; failure of processing and mining equipment to perform as expected; labor disputes; supply problems; uncertainty of production and cost estimates; the interpretation of drill results and the estimation of mineral resources and reserves; changes in project parameters as plans continue to be refined; possible variations in ore reserves, grade of mineralization or recovery rates may differ from what is indicated and the difference may be material; legal and regulatory proceedings and community actions; accidents, title matters; regulatory restrictions; permitting and licensing; volatility of the market price of Common Shares; insurance; competition; hedging activities; currency fluctuations; loss of key employees; other risks of the mining industry as well as those factors discussed in the section entitled “Risk Factors” in the Company’s Annual Information Form dated March 30, 2017. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements or information. The Company disclaims any intent or obligation to update forward-looking statements or information except as required by law, and you are referred to the full discussion of the Company’s business contained in the Company’s reports filed with the securities regulatory authorities in Canada. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that could cause results not to be as anticipated, estimated or intended. For more information on Nevada Copper and the risks and challenges of its business, investors should review Nevada Copper’s annual filings that are available at www.sedar.com.

The Company provides no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

Alternative Performance Measures

“Copper Production Costs”, “LOM Operating Costs”, “LOM site unit operating costs” and similar terms are alternative performance measures. These performance measures are included because these statistics are key performance measures that management may use to monitor performance. Management may use these statistics in future to assess how the Company is performing to plan and to assess the overall effectiveness and efficiency of mining operations. These performance measures do not have a meaning within International Financial Reporting Standards (“IFRS”) and, therefore, amounts presented may not be comparable to similar data presented by other mining companies. These performance measures should not be considered in isolation as a substitute for measures of performance in accordance with IFRS.

For further information call:

Eugene Toffolo, VP, Investor Relations & Communications

Phone: 604-683-8266

Toll free: 1-877-648-8266

Email: etoffolo@nevadacopper.com

Robert McKnight, P.Eng.,

Executive Vice President & CFO

Phone 604-683-1309

Email: bmcknight@nevadacopper.com

[1] Source: SEDAR-filed NI 43-101 Technical Report entitled “NI-43-101 Integrated Feasibility Study, Pumpkin Hollow Project, Yerington Nevada”, with an effective date of April 15, 2015.

[2] Copper equivalent calculations assume copper, Au and Ag prices of $3/lb, $1,300/oz. and $17/oz and metallurgical recoveries of 89.5% 67.3%, 56.3% respectively

[3] Source SEDAR-filed NI 43-101 Technical Report entitled “NI-43-101 Integrated Feasibility Study, Pumpkin Hollow Project, Yerington Nevada”, with an effective date of April 15, 2015.