Why Timing and Location Couldn’t be Better for Nevada Copper

July 23, 2018

In 2017, for the first time in fifteen years, copper mine output declined. At the same time, demand has been increasing - partly in line with global growth and partly due to electric vehicles and energy storage.

The market is emerging from a long period of copper price pressure and has discovered that very little money has been invested in bringing on new projects for new copper supply.

The situation gets even more interesting when you take a detailed look at the project pipeline and realize that only 20 relevant projects in the entire World could possibly come online before 2025 and of those 20 projects in total they account for just 1.3 million tonnes of copper.

It looks a lot like zinc did maybe two years ago, which is to say you’ve got a structurally short market coming right into an inflection point.

Let’s take a closer look at some facts and figures.

You have 23 million tonnes of demand today. If you project forward, based on analyst forecasts, nearly six million tonnes of incremental demand is expected by 2025. Here’s how that demand breaks down:

Copper demand traditionally increases in line with the global economy. So, if we look at two percent global growth over the next five to seven years, that is equivalent to an extra four million tonnes of copper demand.

On top of that four million tonnes, you now have an entirely new source of incremental demand emerging, which is the grid build-out. I’m referring to the power grid upgrades and expansions required to support renewable energies and the electrification of the global transport fleet.

Let’s look at the vehicles first. Your average gas-powered vehicle uses about 23 kg of copper. Your average electric battery-powered vehicle uses 110 kg of copper.

So, you’ve got a four-to-five times multiplier gain from an internal combustion engine to an electrical engine. If you multiply that differential by the consensus projection for new EV sales for 2025 you get to around 800,000 tons. And in case you were wondering how serious the automakers are about the effect of EVs on copper supply, we recently saw BMW enter into a long-term framework agreement to secure sustainable supply of copper with Codelco - the world’s largest copper miner. Automakers are learning their lessons from lithium and cobalt supply and don’t want to get caught out with copper.

But the vehicles themselves are just a part of the story. What happens when you plug these new battery vehicles in at night?

Without serious action by utilities and governments, if we reach expected EV numbers by 2025, the lights will go out every night when people plug in their vehicles because the Western world electrical distribution networks simply can’t handle the load. So, as EV use grows, you’re going to see build-out and upgrades of grid-related infrastructure. Conservative estimates put that at another 1 million tonnes of copper by 2025.

How is all of this new demand going to be met?

As I’ve mentioned, there are very few copper projects that can be built this cycle. To compound that problem, a lot of supply is coming out of difficult jurisdictions. It’s interesting that you often hear concerns about cobalt in the Congo. Yet the fact is a significant amount of copper also comes out of the Congo, as well as other risky regions such as Indonesia and Zambia. Then there are copper producing countries like Chile where you’ve got chronic cost escalation and mineral grade decline.

In other words, the supply side is really facing a great challenge - meet rising demand in a sustainable way.

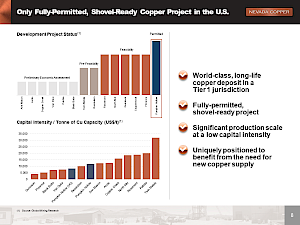

To accomplish this, we believe you need to see a renaissance in the North American copper industry, in particular, the U.S. We have significant mineral endowment in the US, but a structural permitting problem. It takes about seven-to-ten years to permit a new mine in the US. That problem works in Nevada Copper’s favor because, If you look across the U.S., there’s only one copper mining project of large scale that exists with full permitting and it’s our Pumpkin Hollow project - host to an underground mine and an open pit mine.

However, what we’re doing at Nevada copper goes beyond putting those mines into production. We are working to build a fully-integrated domestic American value chain.

Our mine site is just 1.5 hours from Reno. Halfway between us and Reno - just 45 minutes drive away - is the Tesla Gigafactory. Also nearby, via direct route by rail, is the Rio Tinto, Kennecott smelter and then down in Arizona is the ASARCO, Hayden smelter.

Kennecott is already taking third party feed today, and Hayden runs around well below its designed utilization rates, because of limitations in copper concentrate feed. These represent logical domestic outlets for our concentrate. This provides freight benefits, but it also opens the ability to create a “U.S. closed loop value chain” where you mine , smelt and consume in the US. This is an important factor in a world of increasing trade tensions and rising freight costs.

You’re going to hear this a lot from us going forward as we execute on our strategy. We believe we have the right project, the right team and the right timing. Stay tuned and we’ll continue to share our thoughts on the industry and our progress towards production next year.

Stephen Gill, Chairman of Nevada Copper